- BPO continues to be an immense growth and employment driver, allowing Filipino providers to serve multiple international organizations.

- Despite feeling its shockwaves, the BPO industry adjusted quickly and invested in infrastructure that kept operations running efficiently.

- AI software is revolutionizing the customer experience for outsourcing companies in this country, providing swift assistance to customers on basic requests and streamlining workflows.

- With lower labor costs and a talent pool of experienced professionals, the Philippines is remaining the apex destination in Southeast Asia for Shared Services Companies.

In 2017 the Philippine IT-BPO industry employed more than 1.35 million and reached 22.1 billion US dollars of revenue.

By 2018 and 2019, the service sector contributed around 60% of the Philippines’ overall economic growth.

Despite the challenges brought about by the pandemic in 2020, BPO companies managed to maintain their operations through flexible work arrangements, generating a total of $26.7 billion.

In addition, BPO companies experienced a 1.8% growth in employment, reaching an overall total of 1.32 million workers based in the Philippines.

In 2021, the export revenue of information technology and business process management skyrocketed by 10.6%, amounting to an impressive $29.49 billion – a significant increase from 2020’s figure of $26.7 billion.

The BPO industry continues to be an immense growth and employment driver, allowing Filipino providers to serve multiple international organizations.

It’s projected to generate around 1.1 million direct jobs by 2028, providing invaluable employment opportunities in the Philippines.

Here are some of the developments to look out for in the BPO and SSC industry in the coming years:

1. BPO will continue to drive the office market

It was predicted that the BPO industry would yield a 7.8 percent annual growth in full-time employees until 2022.

According to the IBPAP, the industry is ‘shifting toward higher value BPO services,’ and the provinces present tremendous growth opportunities.

For 2020, the industry will continue to grow as forecasts show a continued interest of multinational investors in the country. The IT-BPM sector remains the most significant demand driver for office spaces at 36% and 35%, respectively.

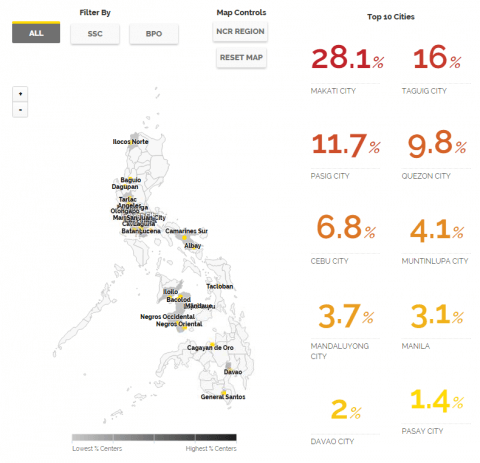

Data from SSON Analytics in 2016 shows that compared to the SSCs, BPO hubs are more diffused across the country and outside city centers.

Furthermore, the BPO industry has experienced amazing growth in recent years, boasting a whopping 1.44 million full-time employees and recording $29.1 billion in revenue in the first half of 2022 alone, according to the IT & Business Process Association of the Philippines (IBPAP).

The BPO industry should be a vital driver of the Philippine economy’s revival after enduring Covid-19.

Despite feeling its shockwaves, it adjusted quickly and invested in infrastructure that kept operations running efficiently.

As such, this sector is uniquely positioned to aid the country during these trying times.

2. BPO revenues will overtake OFW remittances

The BPO industry is well-poised to pass the country’s primary source of dollar income, the overseas Filipino workers’ remittances. OFW remittances are pegged at 4.2 percent annual growth for the first quarter of 2019, while the BPO revenue is steadily at a 9% yearly growth. Globally, the sector covers around 10-15% of the outsourcing market. New BPO hubs are also coming to the country.

According to the IBPAP, the industry generated US$22.9 billion in revenues in 2016, eventually surpassing OFW remittances from 2019. The association also expected the sector to reach up to $38.9 billion in revenues by 2022.

According to Bangko Sentral ng Pilipinas (BSP) Governor Diwa Guinigundo, not only is it plausible for BPO revenues to outrank remittances in terms of money, but remarkably enough this could be achieved with a growth rate of up to 10%.

This number exceeds the 4 percent average annual growth estimated by remittance statistics. Thus, investing in BPO endeavors promises more promising and perhaps even lucrative financial returns.

Of course, this overtake also due to the slowdown in OFW remittances caused by the economic downturn in developed countries and fluctuating oil prices. BPO’s steady growth in the country will offset this stagnation in OFW remittances, which is vital to the buoyancy of the Philippine economy.

According to the Department of Information and Communications Technology (DICT), the Philippines’ BPO sector may soon overtake OFW remittances in terms of growth by 2022 and beyond.

DICT Secretary Ivan John Uy expressed during an economic briefing in Singapore Wednesday that the BPO sector has a projected growth rate of 10%. Still, with careful planning and effort, he believes it can reach 15%.

For 2021, personal remittances totaled $34.88 billion – a 5.1% rise from the previous year and lower than the 6% goal of Bangko Sentral ng Pilipinas (BSP).

Uy further added that this industry might soon overtake OFW remittances.

3. The BPO sector will be affected by the political climate

In a KPMG report titled “Global IT-BPO Outsourcing Deals Analysis,” 64.7 percent of total outsourcing services contracts in the Philippines came from the United States, followed by the United Kingdom at 9.2 percent, with Australia and France being two other key outsourcing markets.

According to some experts, the Philippine BPO industry will be less likely isolated from the global political landscape, especially now that the IT-BPM Plan for 2022 is taking place.

A cloud of uncertainty, however, hovers over the BPO industry worldwide due to the United States’ foreign strategic policy (FSP) uncertainties. According to Bullhorn’s Trends Report 2017, firms in the US rank the US foreign strategic policy as third in their list of critical challenges, next only to talent shortage and pricing pressure. Thus, many US employers rank outsourcing recruitment processes as their least priority in 2017.

In 2022, President Ferdinand “Bongbong” Marcos, Jr. recently visited Indonesia and Singapore on state visits to sign agreements for inviting more foreign investments into the Philippines to aid its economic revival.

During this trip, other government officials accompanied him as they discussed various matters related to improving the nation’s economy.

DICT Sec. Ivan John Uy noted that the BPO companies in the Philippines remain a prime destination and a sector that has contributed billions to the Philippine economy.

The DICT official noted that the country is ready to offer BPO companies a competent digital labor force as it continually provides training programs to advance Filipino workers’ digital skills to satisfy the industry’s needs.

4. The BPO sector will harness the power of AI

People worldwide are beginning to understand and appreciate how much technology can enhance workflows, optimize efficiency, and improve user experiences.

BPO companies in the Philippines use Artificial Intelligence (AI) to optimize their processes and ensure top-notch customer service.

Ralf Ellspermann, CEO of Piton-Global, expressed that when examining the daily call volumes to contact centers globally, particularly in the Philippines, it’s conspicuous that most of them are recurrent and straightforward calls.

In reality, prior to AI, 60 percent of Humana’s 1 million monthly incoming calls were repetitive requests – an ideal instance for utilizing Artificial Intelligence technology.

AI software is revolutionizing the customer experience for outsourcing companies in this country, providing swift assistance to customers on basic requests and streamlining workflows.

As the need for customer service continues to rise, contact centers in the Philippines and globally have grown beyond answering phone calls.

Now, with the help of AI, BPO companies are better equipped than ever to tackle customers’ needs quickly and efficiently.

The Philippines, Still a Leading SSC Destination in Southeast Asia

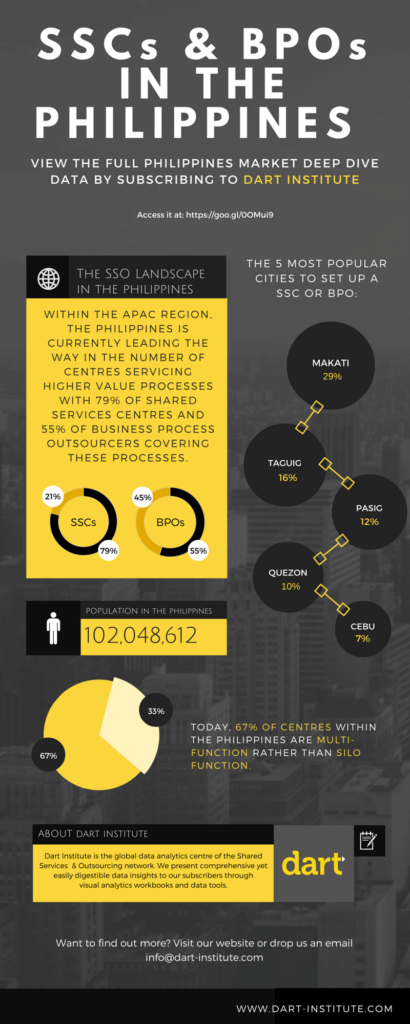

Like the BPO industry, the shared services sector continues to be on a roll. According to an SSON Analytics report, with a 64 percent upsurge in Shared Services Centers (SSCs) in the ASEAN region from 2010 to 2015, the Philippines is poised as the top destination for shared services.

In a separate report by SSON Analytics focusing on the Philippines’ BPO and SSC market, with more and more businesses looking to jump-start operations in the country, the Philippines’ SSC industry has overtaken the BPO industry as the primary driver of growth in the Philippines since 2010. It means more new entrants in the SSC sector than in BPO.

According to the Philippine Statistics Authority’s report in early 2022, the country saw an impressive 7.7 percent GDP growth during the final quarter of 2021, leading to a total 5.6 percent annual economic expansion for 2021.

The IT and Business Process Association of the Philippines (IBPAP) forecasts that, between 2021-2022, the industry will generate a whopping USD 29 billion in revenue while providing 130,000 people with employment opportunities.

The Philippines has become a premier destination for outsourcing due to many reasons.

Philippine outsourcing companies have an edge in this area, offering their services at a drastically reduced cost without compromising quality.

With a proficient talent base and a culture of adaptability, the Philippines is an ideal location for any company due to its widespread use of English in schools.

Moreover, the Philippine government has deliberately established many effective strategies to make business process outsourcing an opportunity for the country.

Related: The Philippines’ Shared Services Growth Led by Captive SSCs

Final Thoughts

The BPO industry is robust, and the outlook for the industry is rosy. Experts believe it will be able to generate around US$40 billion despite the uncertainties posed by the political climate across the globe.

On the other hand, the Philippine captive SSC sector is still driving the shared services growth in the country. While BPO hubs outnumber SSC hubs, the SSC sector has already overtaken the BPO industry in terms of new entrant growth rate since 2010.

However, there is an overarching challenge to the general offshoring and outsourcing industry: the vagueness of the effects of US-China relations on trade and investments, especially here in Asia.

The rise of Automation and Artificial Intelligence in the Fourth Industrial Revolution will certainly drive a shift in the BPO sector.

It’s no longer enough to offer services that only provided value yesterday; new standards are being set each day, so businesses must adapt or risk stagnation. Already, changes have been made – and more are on their way.

As such, the industry is advised to prepare for possible transitions and shift to offering more high-value services.

References

Aguinaldo, M. (2019). High demand and common needs: A look at today’s office space market. Retrieved from https://www.bworldonline.com/sparkup-work-high-demand-and-common-needs-a-look-at-todays-office-space-market/

Cuaresma, B. (2018, October 10). The Green-back faucet. Retrieved from https://businessmirror.com.ph/2018/10/11/the-green-back-faucet/

Cuaresma, B. (2019, May 15). OFW remittances hit 5-month high in March. Retrieved from https://businessmirror.com.ph/2019/05/16/ofw-remittances-hit-5-month-high-in-march/

Fortuno-Mioten, E. (2018). Opening up new opportunities for growth. Retrieved from https://www.bworldonline.com/opening-up-new-opportunities-for-growth/

IT and Business Process Association of the Philippines. (2017). The Philippine IT-BPM sector roadmap 2022 Accelerate PH: Future-ready executive summary. Retrieved from http://boi.gov.ph/wp-content/uploads/2018/03/Executive-Summary-Accelerate-PH-Future-Ready-Roadmap-2022_with-corrections.pdf

SSON Analytics. (2016). Growth of shared services centres in the ASEAN region 2016. Retrieved from https://www.sson-analytics.com/analytics-workbook/growth-shared-services-centres-asean-region?utm_source=aseanarticlesson&utm_medium=portal&utm_campaign=-external-other&utm_term=asean_vaw&utm_content=text&mac=dart_ssonarticleasean&disc=dart_ssonarticleasean

SSON Analytics. (2016). Philippines market deep dive: Captive SSCs and BPOs (2000 – 2015). Retrieved from https://www.sson-analytics.com/analytics-workbook/philippines-market-deep-dive-captive-sscs-and-bpos-2000-%E2%80%93-2015?mac=dart_ssonarticleph&disc=dart_ssonarticleph&utm_source=SSON&utm_campaign=Philippines_2016_VAW&utm_medium=SSON_Analytics_Column

SSON Analytics. (2016). The Philippines’ shared services growth Led by captive SSCs. Retrieved from https://www.sson-analytics.com/blog-entry/philippines%E2%80%99-shared-services-growth-led-captive-sscs

Panay News. (2021, May 27). BPO industry revenues hit $26.7B in 2020. Panay News. Retrieve on January 12, 2023 from https://www.panaynews.net/bpo-industry-revenues-hit-26-7b-in-2020/

Campos, O. (2022, June 8). BPO revenues rose by 10% to $29.5b in 2021. Manilastandard.net. Retrieved on January 12, 2023 from https://manilastandard.net/business/it-telecom/314234726/bpo-revenues-rose-by-10-to-29-5b-in-2021.html

Jocson, L. (2022, December 26). Services, BPOs, semiconductors to remain growth drivers in 2023. Retrieved on January 12, 2023 from https://www.bworldonline.com/economy/2022/12/26/495247/services-bpos-semiconductors-to-remain-growth-drivers-in-2023/

CNN Philippines Staff. (2022, September 7). PH BPO sector growth may soon overtake OFW remittances. CNN Philippines. Retrieved on January 12, 2023 from https://www.cnnphilippines.com/business/2022/9/7/BPO-sector-growth-may-soon-overtake-OFW-remittances.html

The Manila Times. (2022, November 24). How Outsourcing Providers in PH leverage the power of AI. The Manila Times. Retrieved on January 12, 2023 from https://www.manilatimes.net/2022/11/24/public-square/how-outsourcing-providers-in-ph-leverage-the-power-of-ai/1867641#:~:text=BPOs%20in%20the%20Philippines%20have,who%20is%20handling%20the%20call.

Marcelo, E. (2022, April 22). Why set up shared services in the Philippines?. Retrieved on January 12, 2023 from https://www.grantthornton.com.ph/insights/articles-and-updates1/from-where-we-sit/why-set-up-shared-services-in-the-philippines/

0 Comments